On February 14th 2023, Forbes came out with a list of America’s Best Banks. Silicon Valley Bank was listed as number 20. In February Jim Cramer urged investors that Silicon Valley was a buy with room to run. Of all the analyst coverage on bank stocks, two analysts, David Long of Raymond James and Brandon Kind of Truist, were the only two to have downgraded SVB recently; most had an outperform or buy rating with price targets as high as $600 a share. On Wednesday, March 8th, on an investor call, the bank surprised its investors, letting them know they needed to raise $2.25 billion to sure up its balance sheet after suffering a $1.8 billion loss. Big venture capitalist firms such as Coatue Management, Union Square Ventures, and Peter Thiel’s Founders Fund advise their investors to pull funds. Peter Thiel’s Founders Funds had pulled all assets by Thursday morning. News spread fast on social media, by the end of the day $42 billion in withdrawals were requested. By noon on Friday, the bank had failed and was shut down by the California Regulators, making it the largest banking failure since the Great Financial Crisis.

So how and why did this happen? Is your money safe where it is? Let us take a look.

First, you must understand what Silicon Valley bank is; their core clients were startups, mainly in the technology and life science space.

Private clients only made up a small percentage of their business. FDIC insurance protects up to $250,000 per depositor per account type. Silicon Valley had the highest percentage of deposits over that threshold with 97% exceeding FDIC limits. Given these unique attributes, it is important to understand that they are not like all other banks. While they had FDIC sweep programs that could go up to $5 million, most clients weren’t using them. As one could imagine, as this realization set in, depositors rushed to get their funds out turning it into a bank run.

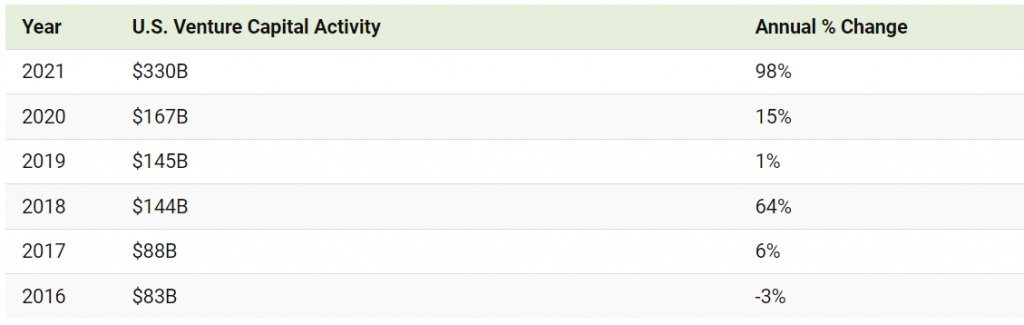

If we want to understand what caused the bank’s losses, we must look back to economic changes over the past few years. In 2020 technology companies exploded higher, fueled by low-interest rates. Silicon Valley Bank benefited from this, taking in tons of deposits in 2020 and 2021, which in turn were invested in fixed-income securities with low-interest rates.

Matt Levine at Bloomberg had a good write-up on this. “But there is another, subtler, more dangerous exposure to interest rates: You are the Bank of Startups, and startups are a low-interest-rate phenomenon. When interest rates are low everywhere, a dollar in 20 years is about as good as a dollar today, so a startup whose business model is “we will lose money for a decade building artificial intelligence, and then rake in lots of money in the far future” sounds pretty good. When interest rates are higher, a dollar today is better than a dollar tomorrow, so investors want cash flows. When interest rates were low for a long time, and suddenly become high, all the money that was rushing to your customers is suddenly cut off. Your clients who were “obtaining liquidity through liquidity events, such as IPOs, secondary offerings, SPAC fundraising, venture capital investments, acquisitions and other fundraising activities” stop doing that. Your customers keep taking money out of the bank to pay rent and salaries, but they stop depositing new money.”

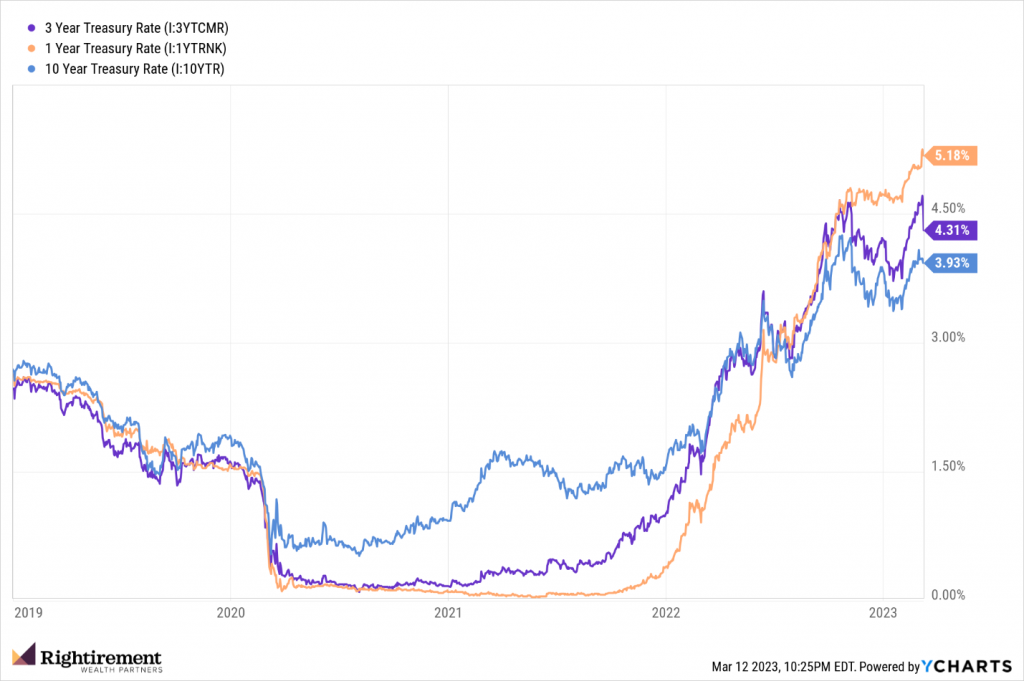

Money flowed into the bank during a historically low-interest rate environment, the bank invested at these low-interest rates. As interest rate’s climbed higher, its clients, mainly focused in the technology sector, had higher than normal needs to withdraw cash to meet business costs. The bank’s investments were faced with market losses as interest rates climbed. Last year the 10-year US treasury was down over 10% as rates rose quickly.

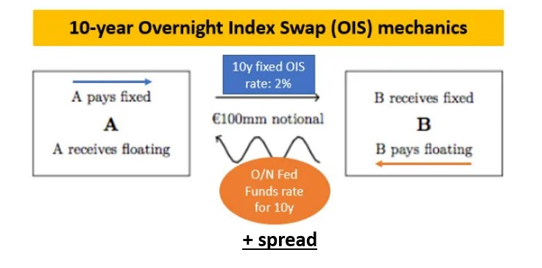

Interest rate risk is an obvious risk to any bond investor, however Silicon Valley Bank failed to hedge its interest rate risk when rates were low. Interest rate swaps are used to hedge risk on bond portfolios, but the bank failed to do this. Alfonso Peccatiello had a great write-up on the risk management failures of the bank. A $120 billion bond portfolio with 5.6 year duration loses $700 million for each 10 basis point increase in five-year rates.

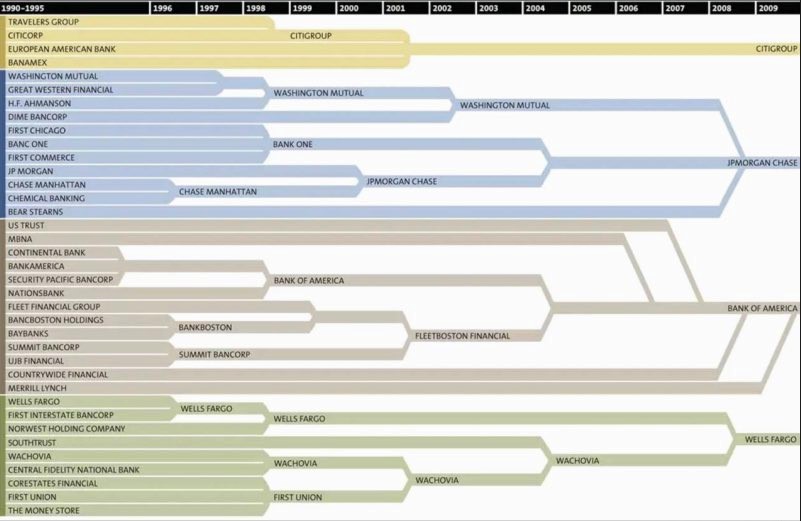

At the time I am writing this, Signature Bank has just been closed by regulators. The Federal Reserve announced they would backstop depositors, as they should, to show the market confidence. A casualty of the Silicon Valley Bank failure will be depositors that panic in smaller less stable banks. The unfortunate result of this bank run will be that massive banks benefit from the pain of small banks. In 1972 we had 13,612 banks in the US; in 2021 only 4,237. Below, you can see how the big four banks, Chase, Bank of America, Citi and Wells Fargo, took over many smaller banks over time.

This is not a time to panic but make sure you are careful. You would get your funds back if you have below the FDIC insurance limit and your bank fails, even without a federal backstop. If you have funds that exceed $250,000 per depositor, ask if your bank offers an FDIC sweep program that spreads your funds over multiple banks automatically.

A couple could have two individual accounts and one joint bank account and potentially be protected up with up to $1 million of FDIC insurance. If you are earning no interest at your bank, check Nerdwallet to see what banks are offering the best rates and take advantage of today’s higher rates. Now is also an excellent time to check account ownership. Not only does your account registration matter for FDIC insurance coverage, but it is also important for overall estate planning. You can tackle two potential problems in one review and update.

We are in an uncertain time, with high inflation, high geopolitical tensions, unbalanced global supply chains, and an ongoing health crisis. Oddly enough, an event like this could be bullish for stocks as the Federal reserve may be forced to stop hiking rates or even cut rates. The latter would be a positive catalyst for equity and bond markets.

Do not over think this event; check your bank accounts and make sure you are set up properly to take advantage of maximum FDIC insurance as it applies to your financial situation. If you have a quick question about FDIC insurance or any other financial topic feel free to give us a call or send us a note. We are here to help and you do not need to become a client for us to provide some brief advice.

Disclaimer:

Content in this material is for general information only and not intended to provide specific advice or recommendations for any individual. All performance reference is historical and is no guarantee or future results. All indices are unmanaged and may not be invested into directly.

The economic forecasts set forth in this material may not develop as predicted and there can be no guarantee that the strategies promoted will be successful.

Any company names noted herein are for educational purposes only and not an indication of trading intent or solicitation of their products or services. LPL Financial doesn’t provide research on individual equities.

Stock investing includes risks, including fluctuating prices and loss of principal.

Bonds are subject to market and interest rate risk if sold prior to maturity. Bond values will decline as interest rates rise, and bonds are subject to availability and change in price.

Government bonds and Treasury bills are guaranteed by the US government as to the timely payment of principal and interest and if held to maturity, offer a fixed rate of return and fixed principal value.